In the report, Hindenburg claimed that Block's ex-employees estimated that 40 percent to 75 percent of the accounts they reviewed were fake, involved in fraud, and multiple accounts belonging to the same person.

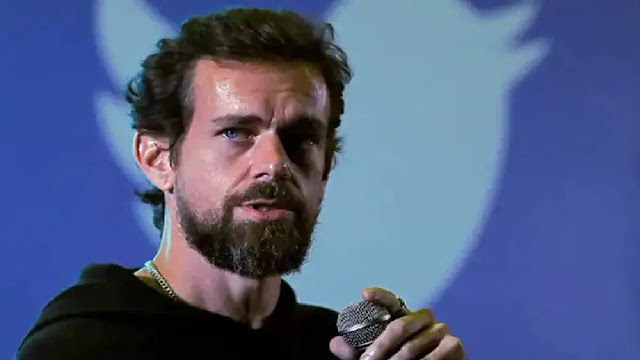

Hindenburg Research has accused Jack Dorsey's payment firm Block Inc of fraud, claiming that the company exaggerated the number of its users and understated customer acquisition costs. The American short seller said that their two-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to help.

What did the company claim

After the Hindenburg report, the shares of Block are witnessing a decline of about 17 per cent in the pre-market. In a report titled "Block – How Inflated User Metrics and 'Frictionless' Fraud Facilitation Enabled Insiders to Cash Out Over $1 Billion," Hindenburg claimed that Block X employees estimated that 40 percent to 75 percent of the companies they reviewed The accounts were fake, involved in fraud and multiple accounts of the same person were also present.

Lso accused

The report said, “Block, formerly known as Square, is a company with a market cap of $ 44 billion. In the report of Hindenburg Research, it has been alleged that the company has been continuously misleading the investors. Has also tampered with the facts. There are many types of flaws in the company's app, which are constantly being hidden. On March 23, the founder of Hindenburg Research had informed about the new revelations by tweeting in the morning. Through tweet, Hindenburg had given information about the new report coming. Hindenburg Research is an American short seller research company, whose founder name is Nathan Anderson.

Many allegations were made against Adani Group

The firm made headlines in India earlier this year when it published a report titled "Adani Group: How the World's Third Richest Man is Pulling the Largest Cone in Corporate History". In the report, Hindenburg accused the Adani Group of stock manipulation and accounting fraud. Following the report, Adani lost his title as Asia's and India's richest man, resulting in over $150 billion erosion from Adani Group's market cap since January 24.

No comments:

Post a Comment